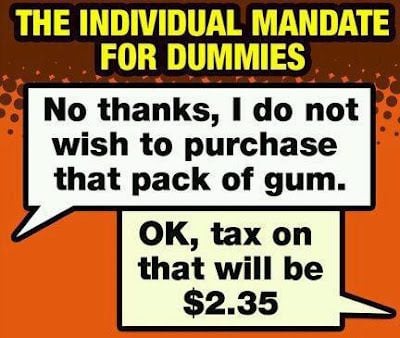

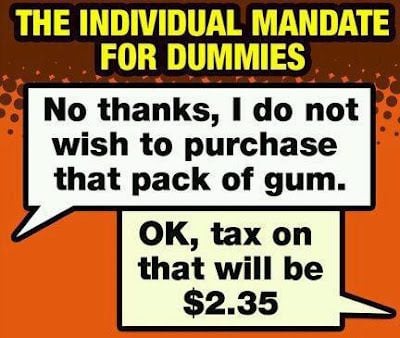

Obamacare – It’s a tax.

The media finally got around this week to report on how Obamacare will cause your taxes to go up.

Yahoo reported:

The Affordable Care Act, colloquially known as Obamacare,

completely changed how people get health care. With a big expansion of

health insurance through mandatory coverage requirements, tens of

millions of uninsured Americans will find themselves needing to get

enrolled…

…Going forward, though, Obamacare imposes additional Medicare taxes on certain individuals. In particular, two groups will be affected:

- Joint filers with wages or other work-related earnings greater than

$250,000 and singles earning more than $200,000 will have to pay an

additional 0.9 percentage points in Medicare tax, bringing their total

to 2.35% for employees or 3.8% for self-employed workers. Employers are

supposed to handle this requirement in their withholding, but for

two-earner couples, that may prove impossible, as your employer will

have no knowledge of what your spouse earns.

- Those with total adjusted gross incomes of more than $250,000 for

joint filers, or $200,000 for singles, will have Medicare taxes imposed

on their investment income as well. On whatever amount of investments

exceeds the $250,000 gross-income level, you’ll have to pay the full

3.8% surtax yourself.

The net effect on high-income earners will be

to bring total top tax brackets to 43.4% — the 39.6% regular tax amount

plus the 3.8% Medicare tax.

Hitting lower-income workers

Those who earn less than the $200,000 and $250,000 thresholds

shouldn’t assume that their taxes will be unaffected by Obamacare. New

limitations on flexible spending arrangements

will hit taxpayers of all income levels, limiting the amount you can

set aside tax-free in a flex plan to $2,500 per year. Previously, there

was no technical upper limit, although most employers imposed a $5,000

maximum. But for those who have high levels of predictable medical

expenses, the forced reduction in flex-plan use could cost you hundreds

of dollars in extra income, Social Security withholding, and Medicare

withholding taxes.

Moreover, those who rely on deducting medical

expenses won’t be able to get as big a tax benefit from them. Obamacare

raised the floor on itemized medical expenses from 7.5% of gross income

to 10%. That may not sound like much, but it could reduce your deduction

by thousands of dollars and thereby increase your tax bill

substantially.

Obamacare adds 17 new taxes or penalties on all Americans. (

Heritage)

No comments:

Post a Comment